Short Put Spreads as an Alternative to High-Yield Debt

Today we explore whether volatility strategies focused on income generation have become viable fixed income alternatives in today's environment.

We find it plausible in a post-COVID economy that heightened volatility in the markets will remain a persistent trend and that the most highly levered companies have become increasingly fragile as they were forced to raise even more debt during the pandemic. Both of these conditions justify a deeper analysis of whether volatility strategies focused on income generation have become viable fixed income alternatives.

Volos SPY Short Put Spread 95-105 Monthly Index

To perform this study we compared the total returns of iShares iBoxx $ High Yield Corporate Bond ETF (HYG) versus the Volos SPY Short Put Spread 95-105 Monthly Index over a trailing 5-year period. The results show that the Volos Index outperforms HYG (13.2% annualized returns vs. 6.7%) and does so with a minimal increase in volatility (10.1% annualized volatility vs. 9%). Other Volos Short Put Spread Indexes that reference equity ETFs such as EEM, EFA, IWM, and QQQ also outperformed over this period (see here).

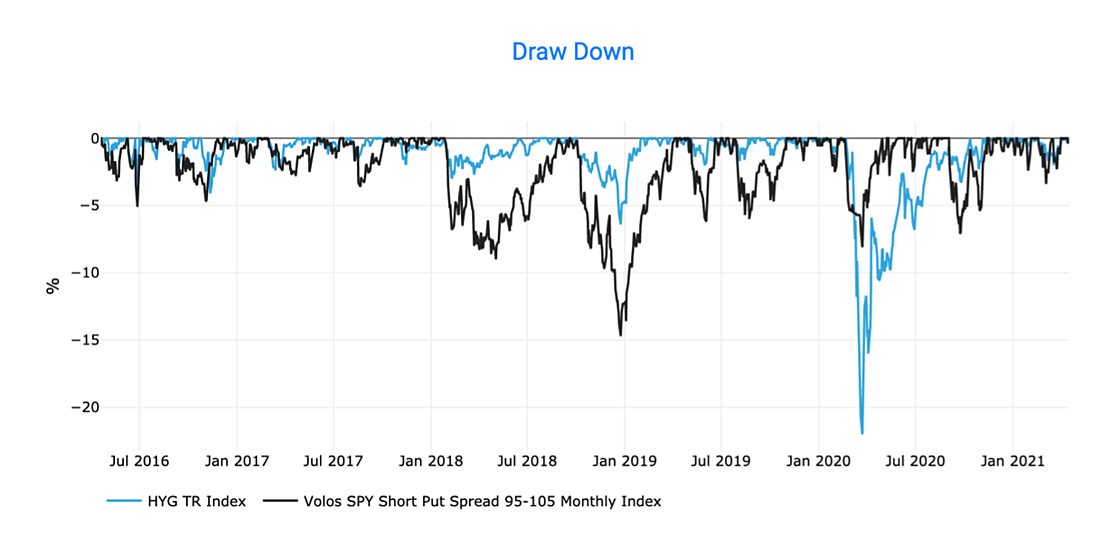

While the Volos SPY Short Put Spread 95-105 Monthly Index did experience larger drawdowns than HYG, we note the astounding outperformance of the Index versus HYG during the COVID induced panic. With corporate balance sheets more highly levered than ever before, we wonder whether:

The strong outperformance of the Volos Short Put Spread 95-105 Index versus HYG is not an aberration and that sharp corrections will become more prevalent compared to a traditional bear market.

Investors should accept outsized drawdowns during market oscillations in exchange for higher returns and lower max drawdowns during tail events.

Volos ETF Short Put Spread Monthly Index Family

Volos provides 24 Short Put Spread Monthly Indexes focusing on the 8 most popular Asset Allocation ETFs for investors to evaluate and benchmark against. Explore all the Volos ETF Short Put Spread Monthly Indexes today by clicking below.

About Volos

Volos provides financial Indexes and technology for institutional investors.

We specialize in indexes for options and derivatives strategies, providing transparency to this traditionally opaque asset class.

For additional information on Index licensing and services, please contact licensing@volossoftware.com.

Disclaimer:

Any Indexes described herein are designed to represent a systematic rules-based options strategy. In the construction of the Indexes there are certain assumptions, in respect of the financial instruments referenced either directly or indirectly in the Indexes, regarding liquidity, transaction costs, margin requirements, taxes, the ability for transactions to be executed at specific times. However, there is no guarantee that market participants trying to replicate the Index or strategy based on the Index will be able to execute all of the required transactions to replicate the Index or strategy. Actual transaction costs could be significantly higher than transaction costs used in the calculation of the Indexes.

This information is provided for general education and information purposes only. No statement should be construed as a recommendation to buy or sell a security or to provide investment advice. The Indexes and all other information provided by Volos and its affiliates and their respective directors, officers, employees, agents, representatives and any third party providers of information (the Parties) in connection with the Indexes (collectively Data) are presented "as is" and without representations or warranties of any kind. The Parties are not be liable for loss or damage, direct, indirect or consequential, arising from any use of the Data or action taken in reliance upon the Data. Investors should consult their tax advisor as to how taxes affect the outcome of contemplated options transactions.

Past performance may not be indicative future returns. The timeseries of the Indexes contain back-tested data, prior to when the Indexes were launched. Back-tested performance information is purely hypothetical and is provided in this document solely for information purposes. Back-tested performance does not represent actual performance and should not be interpreted as an indication of actual performance.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD). Copies of the ODD are available from your broker, by calling 1-888-OPTIONS, or from The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, Illinois 60606.

Neither Volos Portfolio Solutions LLC (Volos) nor any of its principals, directors, employees or representatives is providing you any investment advice through your use of our website or our software. Volos is not an investment adviser, and is not registered with the Securities and Exchange Commission or any state regulator, and by using this Index you will not be an advisory client of, or otherwise have an advisory relationship with Volos. Volos does not endorse or recommend the purchase or sale of any securities. You are responsible for all aspects of your use of the Index including any decisions about whether to buy or sell securities as a result of using the Index. Volos is not a registered broker-dealer and is not regulated by the Financial Industry Regulatory Association (FINRA). Securities trading, including options trading, entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Investments in securities involve the risk of loss, including total loss of an investment.